Operating or growing a website or online business is a skill set to be learned, yet buying or selling one requires an entirely different set of skills.

While you may be focused on the income that your website provides as you build it over the years, you might not have thought much about what it’s actually worth.

If your site is generating revenue, it’s also an asset that can be sold.

As a seller, going to marketplaces and asking what your site is worth is for rookies. In the same way for buyers, seeing a seller’s asking price does not mean that their valuation is in line with reality.

Sure, it’s good to understand what the market is doing as a whole, but if you want to maximize any sort of transactional event, you need to come equipped with your own knowledge.

In this post, I’ll run you through the key things you need to know about website valuations. Throughout the article you’ll also learn how to increase the valuation of your site, if you’re planning to sell it in the future.

Terminology Used in Website Valuation

A lot of online business owners are self-educated. Combine this with the fact that tertiary-educated corporate investors are taught different terminology depending on where they are located.

As a result, we can speak a different language at times!

The good news is, after many decades of ambiguity, some common standards have emerged when it comes to valuing websites.

SDE

Typically in business valuations you’ll see many references to EBITDA. For websites, this will typically be SDE, or seller’s discretionary earnings.

I’ve written about the difference between SDE and EBITDA before, but to simplify it all greatly, SDE is just EBITDA + the owner’s salary.

SDE will be calculated on a:

- monthly basis, or

- annual basis.

If the business is larger and the broker usually deals with more traditional assets, expect to see an annual basis. If it’s under $2.5M and listed with a broker who deals solely with online businesses models like websites that generate passive income, chances are they will use a monthly basis.

Profitability

In light of what I noted above, profitability can another way of saying seller’s discretionary earnings. So we can consider a website’s ‘profit’ to be the amount that the seller earns after deducting all fees and operating costs from the revenue.

Expect to see some variations and subjectivity when it comes to how the profitability of a website is calculated.

Sellers and brokers will optimise these calculations to maximise how profitable the business looks, just as many buyers will want to see certain items excluded or reduced to reduce how profitable the business looks.

As you will learn below, when applying a multiple to these amounts, manipulating the profitability of a business can affect both the asking price and the final sale price by a great deal.

The good news, is that most websites are extremely simple businesses. There are generally very few operating expenses, so there’s often very little to manipulate.

Earnings Multiple

Once the profitability, or SDE of a website is established, an earnings multiple will be applied to it. This can also be referred to as a ‘valuation multiple’.

The basic calculation is:

seller’s discretionary earnings x multiplier = valuation

As noted above, website brokers and sellers may use an annual or monthly basis. It doesn’t matter which is used, as I’ll show you in these examples below.

Annual Basis Example

Business A is a website that generates $150,000 each year in SDE for the owner. Based on how it’s performing and the assets included, the broker feels that a valuation of 4x is fair.

$150,000 x 4 = $600,000

As you can see, this website is valued at $600,000.

Monthly Basis Example

Business A generates $150,000 each year for the owner, but the broker breaks this down to show an SDE of $12,500 each month. Based on past performance and assets included, the broker feels that a valuation of 48x is fair.

$12,500 x 48 = $600,000

As you can see, the website is also valued at $600,000.

Converting Annual Multiple to Monthly (and Vice-Versa)

Converting one basis to another is simple:

annual / 12 = monthly monthly * 12 = annual

Why Are Multiples So Important?

Unless the website is underpriced, the valuation multiple is sure to be debated at some point. There are good reasons for this, both from the buyer and the seller’s perspective.

For a buyer, the amount they pay for the asset will determine the future expected return on investment (ROI) that they will see. The higher the multiple, the more they pay, and the lower their ROI.

This also increases their risk. If they pay a valuation of 42 months, it means the business has to perform as well for 42 months into the future for them to get their original investment amount back. Only in month 43 will they see a profit, if you will.

For a seller, they need to weigh up questions like:

- If I just hold on to the website and let it earn money for me, how long would it take to earn the same amount?

- How long will it take me to build a new website to earn the same amount?

- Where will I invest the proceeds from the sale of my site? Can I get a better ROI vs holding on to my business?

Factors Affecting Valuations

Up until now, most of this process can be run by numbers by most people, but from here it gets trickier.

There are multiple factors that can determine and affect the value of a website. I can’t promise to give you an exhaustive list, because all assets are different and buyers and sellers will come with their own perspectives.

What you will see however, is a common list of factors that can direct a valuation multiple.

Time Commitment

This one deserves to be at the top of the list. Buyers aren’t only using capital when investing in websites, they’re investing time.

Consider that many investors are wanting to buy their way out of a job, because they are tired of working 40 hours a week for the man, only to take home $80,000.

Put yourself in their shoes. Would you want to invest $240,000 of your hard earned cash, putting it at risk, to earn $80,000 and work 40 hours a week? You work for yourself, sure, but your pocket is $240,000 lighter. This hasn’t really given you any time freedom.

Businesses that use automation and very efficient systems are very desirable because owner-operators don’t want to work 40 hours a week. They are especially valuable to institutional buyers as well because they can have their team operate many businesses instead of just one.

Net Profit and Margins

Say you’re given the option to buy two different websites:

- Website A: 250,000 pageviews per month, 90% net profit, monthly SDE of $12,500

- Website B: 2,500,000 pageviews per month, 10% net profit, monthly SDE of $12,500

If you’re buying to grow, Website A might be a better choice. Why?

2x’ing the traffic on Website A likely takes fewer posts to do so, and shouldn’t cause a substantial increase in hosting costs. If it’s a smaller site, it should require fewer backlinks (assuming it’s getting traffic from SEO) to achieve too.

To achieve the same on Website B could require more content, more backlinks (to avoid diluting the site’s existing authority), and will almost certainly require an increased budget on hosting.

Traffic Sources

There are several ways that websites can receive traffic on a regular basis. These traffic sources can significantly affect the value of your website.

Some examples of these for affiliate sites are:

- Organic Search: These are website visitors who find and stay on your website as a result of searching for things in Bing, Google, Yahoo! and so on. Rather than clicking on the ads (which cost website owners money), they click on the free results. For SEO consultants like myself, this is usually a core source of traffic.

- Organic Social: These visitors come via social networks that link externally. Though Facebook used to be a core source for many, now it’s much more difficult to get traffic from. Today the most common options are Pinterest, Reddit and Twitter, though Twitter requires the most ongoing effort.

- Referrals: Websites link to websites. Without these links, search engines wouldn’t be able to understand which websites are reputable and which are not. But before search engines, this was the only way we could find new websites. When you read this blog post and see me linking to a different website, I’ve just ‘referred’ you to that other site.

As a general rule, the more diverse the traffic sources, the more valuable a website is. Google is known to update their search algorithm in a way that can crush online businesses that rely on their traffic.

But if that same website gets 30% of their traffic from Pinterest and 20% from referrals, they are hurt, but not out of business. That’s something many buyers will pay a premium for.

Revenue Sources

The number of revenue sources a website has can affect the valuation as well. Having more than a single source of revenue can reduce risk, just as multiple sources of traffic can.

Relying on a single source of revenue such as Amazon Associates can keep a site simple to manage, but if they cut their commissions as they have done plenty of times in the past, revenue is cut overnight as well.

By using a strategy with multiple monetisation methods, sites have diversification in their revenue, reducing the investment risk for a buyer.

In some cases, ad networks, affiliate programs, dropshipping partners and so on, can be difficult to gain access to.

As a result, buyers will often pay a premium to buy an asset that gives them access to exclusive partners, and insulates them from their business revenue going to zero.

This said, too many tiny revenue partners can lower your valuation. No serious buyer is going to pay a premium for a business that has 23 sources of income that bring in less than $20 per month. The hassle involved in accounting, managing those partnerships, and keeping links up to date is not worth their time.

Backlinks

When you link your own content to content on another site, it’s like a vote of confidence that implies other site has quality information. These are usually linked to provide more context to the topic on your site, as well as legitimacy in that you are part of a greater editorial community.

These are called backlinks, and search engines use these ‘votes’ to understand which pages should rank better than others.

Quality backlinks are hard to get, and they are expensive. At the time of writing, they are literally a currency in themselves, with many websites charging a flat rate for a link from their site.

Editorial links that fit naturally within their articles, or links published along side a quote are even more valuable, as they have been vetted by a journalist or editor.

The best backlinks which money cannot buy, are worth even more. We’re talking about those in research papers, or from government authorities and reputed organizations. These backlinks bring a massive amount of trust with them, and can mean that:

- the site is less likely to suffer from loss of rankings in future

- if additional content is published to the site, it is likely to rank in search engines well and fast

For this reason, a buyer may pay a premium for a business that is only turning a small profit, but has huge domain authority as it makes a good candidate for website flipping.

In the same way however, poor quality backlinks which can harm the future viability of a website can hurt it’s future valuation. Automated comment links, hacked links, excessive 301 redirecting expired domains or obvious PBN spam can be viewed as a liability, not an asset.

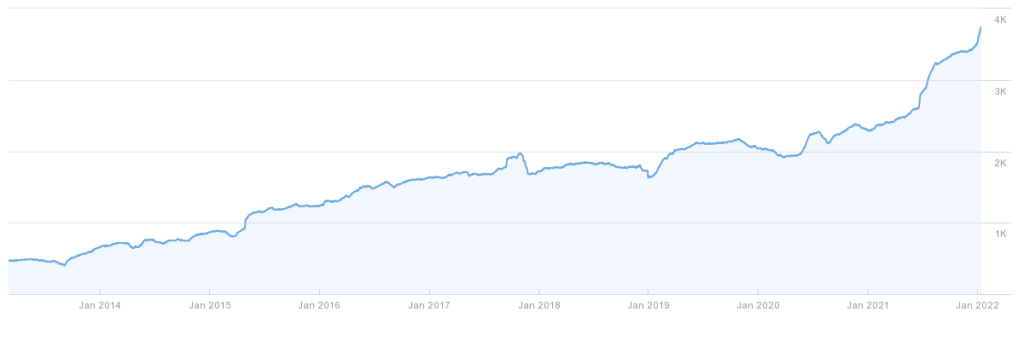

Age & History

Tagging along with backlinks comes the age and history of a website. Generally the sites with the best backlink profiles also have a long history.

Websites that have been around for a long time, and have a stable earnings history over a long period of time, are more desirable than those that were built 8 months ago as once again, they reduce the investment risk for the buyer.

For this reason, when an experienced investor is valuing an internet business, chances are they will pay more for a site with a long history.

It’s far better to buy a wonderful company at a fair price than a fair company at a wonderful price.

Warren Buffett

Experienced investors have often seen the highs and lows that come with online businesses. They have seen the downside risk first hand. So paying a higher multiple for a business that has shown, for a long period of time, that it can survive changing algorithm updates, global pandemics, recessions and changing pop-culture, is kind of a big deal.

Transferability (and Simplicity)

How hard is the business to transfer? If it’s a herculean task, chances are that operating it after the fact is as well.

Some online business models are beautifully simple. Some are not.

But even simple businesses like rank and rent websites can be made unnecessarily complex by their founders. What could be a WordPress install with a lightweight theme and 2 plugins could also be a custom .NET build reliant on 3rd party resources, that requires an expensive, niche developer to keep it maintained.

If you are trying to get a great valuation for your website, it’s important to simplify your business and the handover process, before listing it for sale.

This looks different for every business, but it can mean things like automations, SOPs, templates, contracts, reducing the number of licenses, and so on.

Niche Outlook

The niche or industry of your website can significantly impact its value.

Consider if you had a website that reviews hoverboards. Back when that was a booming fad, the competition was low and the demand was high. But a buyer willing to give it some thought knows that it is unlikely to last. It’s likely to sell for a low multiple as a result.

Compare that to a lead generation website for emergency plumbing. It’s very likely that there will still be strong demand for plumbing services in the decades to come. This should sell for a very fair multiple.

Even better, consider a website about electric vehicles. The market is only beginning to break through right now, and it’s probable that more and more people will buy them in the future. A growing site, in a growing industry is sure to sell for a great multiple.

Upside (Money Left on the Table)

Some website sellers are extremely experienced and driven. Not only are they aware of the opportunities to maximise the revenue their website generates, they are driven and disciplined enough to actually implement these opportunities.

Believe it or not, this is actually a rarity.

Different buyers have a different competitive advantage. A lot of them have a unique playbook that gives them this advantage. This might sound counter-intuitive, but most buyers are willing to pay a little extra for a site that they know has immediate upside for them.

A past example was to buy a ‘made for Amazon’ content website, then put display ads on top. Often it would get a 30-40% earnings boost overnight.

One that I love are sites that generate revenue through Google AdSense or Ezoic. They might not have enough traffic to get onto AdThrive, but if you already have a site with them they’ll let it in. Boom—30% more revenue for 2 hours work, thanks for coming.

In both of these scenarios, the buyer doesn’t increase expenses, so it’s all profit (SDE). By doing so, they decrease their investment risk (by getting their initial investment capital back faster), or they can realise profits much quicker, selling the site after 6-12 months of earnings history with this higher SDE.

Domain

There used to be a myth that .com domains ranked better than all others. I’ve since proven (to myself) that many (and I assume all) gTLDs can rank well. But just because you can, doesn’t mean you should.

.com domains are the most popular TLD as they’ve been around since the inception of the internet and it’s what most people are familiar with. Other TLDs such as .net and .org follow suit when it comes to sought-after domain extensions.

As you’ll see below, branding is important. There’s only so much you can build on bestdogtoyreviews.pet.

The site may only be an affiliate site in your mind when you set out to build it, but a future buyer may want to turn it into an online magazine, something truly legit.

Short, crisp and brandable domains like dogslife.com offer a lot more value to a buyer than long and irrelevant domains. For some buyers, the domain and the backlink profile alone can make your site an insta-buy, even at a high valuation multiple on the current SDE.

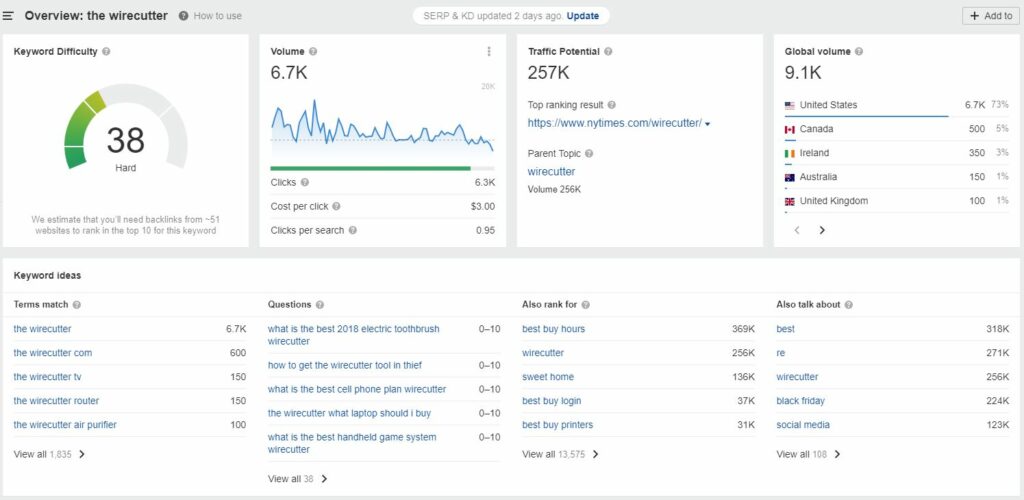

Brand & Following

The more time I spend building, buying, investing and selling websites, the more I see a recurring theme. The industry is maturing, and most buyers are interested in a brand that will stand the test of time.

As we discussed above, this starts with a good domain name. It doesn’t need to be 4 characters and worth a packet, but it should be relevant, and mean something to the audience that it serves.

Something many website buyers will look for is search volume for the brand alone. Great websites have a loyal following that sees people not only searching for the products and information on the site, but the brand itself.

The holy grail is when people are searching for their query, and the brand at the same time. An excellent example of this is Reddit.

There’s a good reason why this is valued so highly—a strong, reputed brand name that has been developed over a decade cannot be replaced by throwing money at a freshly domain next month.

Building a brand takes a lot of time, resources and a solid strategy. It’s highly defensible in a way that bestdogtoyreviews.pet is not.

Take it one step further and consider the websites that you don’t even search for. How many do you use via an app, or type directly into your browsers address bar? Google could completely deindex Reddit tomorrow, and while traffic would be down, I’m confident the business would survive long into the future.

Typical Valuation Multiples

My goal from this post isn’t to tell you exactly what your site is worth. The only person who can tell you that is a buyer willing to send a wire transfer.

Many of the factors above will affect the multiple that a buyer is willing to pay, along with other factors that are important to that individual or group of investors.

But for educational purposes, below are what I consider to be typical multiples (monthly basis). When I’m building or growing websites, I’m not only tracking revenue and SDE, I’m also tracking the overall value of that asset. These are the multipliers I use in my calculations:

- content: 34-46x

- includes display advertising, Amazon Associates and affiliate revenue

- ecommerce: 28-40x

- without ‘owned’ products

- excludes anything with an FBA business attached

- lead generation: 36-47x

- includes rank and rent

But remember, these are just ranges, and there’s no reason why a site won’t sell for more or less. If it’s declined hard last month, you’re going to struggle to sell for a high multiple of the last 12 month average SDE.

Where I’ve tended to do best is in finding strategic buyers. Let’s say I have a lead generation website, where in my business model, a lead is worth $25. If I can sell that directly to a business that provides the service, and I know that lead represents $2500 to them, chances are I can sell the business for a much higher multiple.

This is why you shouldn’t obsess too much over ‘typical multiples’.

So How Much Is Your Site Worth?

Now that you know about the methods that you can use to calculate the value of your website as well as all the factors that affect this kind of value, you can perform the valuation on your own.

The price calculator below simply uses the calculation methods above, but is a bit quicker to use. Add in your average SDE over the last 12 months and pick a multiple from the examples above to find out the approximate value of your website.

Thanks for reading! I hope this guide has helped to shed light on this seemingly complex topic.

If you’re still left with questions however, leave a comment below and I’ll get back to you with a response as soon as I can!

Leave a Reply