If you’re building your business for a better life like I am, chances are you want that business to be:

- cheap to operate,

- easy to manage,

- profitable, and

- without friction (both for you and your clients/customers).

Business isn’t easy, but it doesn’t have to be hard.

As an Australian who has lived in multiple countries and done business with companies all around the globe, I’ve learned a lot about making business unnecessarily difficult.

If you look at that list above, I’ve found myself foolishly operating my businesses through entities that are:

- expensive to operate,

- unbelievably difficult to manage,

- become unprofitable fast after paying agents to fix your problems, and

- have friction at every step, from paying suppliers to integrations to getting paid by clients and customers.

I’d always told myself it was worth it for a myriad of reasons (though mostly just the result of being curious and wanting to have “tried it once”). It rarely was.

Despite being a foreigner, opening a company in America may be the best business decision I’ve made to date. While it won’t solve your business problems, it won’t cause you a heap of new problems. Everything is just… easy!

If you’re a non-citizen, non-resident foreigner and you want to register a company in the USA, this article is for you.

Can a Foreigner Start a Business in USA?

Yes, absolutely. This is as relevant for multi-national brands as it is for solopreneurs. Though the exact percentage is hard to pinpoint, there are plenty of foreign owned LLCs doing business in both America and abroad.

There are a few extra hoops to jump through as a foreigner, but as you’ll see below, they aren’t particularly onerous.

The exception here is that you cannot form an S-Corp without US resident shareholders, but as you will also see below, that’s not a problem for most of us.

Why Do Foreigners Want to Start a Business in USA?

After writing about the best place to incorporate an online business, I’ve spoken with people of all walks of life who, for one reason or another, cannot run their online business in their home country.

Below you’ll see some of the common reasons people cite for deciding to start a company in the USA vs their home country.

Banking

Low cost, government-backed bank accounts that operate in a stable currency with quick transfers to basically anywhere. US banking isn’t perfect, but there’s plenty to like.

Most digital banking products operate out of the US, along with rewards credit cards if you want to go down that track.

Fees

When you’re from a country where it’s very cheap and easy to form a company, you probably don’t give this much thought. In some countries, it can cost thousands in government, legal, notary, and other fees to start a new company, as well as annual renewal fees and any time you decide to make changes to that company.

An example of this is my friend who wanted to start a travel agency in Spain. The start-up company would be required to pay a €140,000 fee to register as a retail agent, then make a €180,000 bond deposit. This is in addition to all of the other registration fees, let alone actually being able to fund the start up costs of the business!

America is like most first world countries, where registration and renewal is very affordable.

Reputation

I was recently contacted by someone from Nigeria. He operates a digital agency providing content to other businesses. While he provides a quality service, his country’s track record online has cost him more in lost sales than he’d like to recall.

By trading through a Wyoming LLC (Limited Liability Company), he now leverages the reputation and trust that comes with American business.

Payment Processing

Another contact is building a SaaS product with her development team in Nepal. They need cheap, reliable, easy-to-integrate payment processing, which they have trouble finding locally.

By trading through a US company, they gain access to Stripe, considered by many to be the gold standard of payment processing.

Ease of Operating

Some countries require company owners to spend a ridiculous amount of time filing paperwork. If you’re living in a country where the native language isn’t English, getting paperwork done in another language can be a real pain.

If you’re a non-resident, non-citizen operating a US LLC in a state like Wyoming, you’re unlikely to spend more than a day or two each year thinking about your actual operating entity.

Though these operating requirements will change down to every individual situation, in a simple scenario of running a disregarded-entity Wyoming LLC, annual requirements will look something like this:

- filing annual compliance report

- renewal of registered agent service

- filing Form 5472 with Form 1120 cover page

Depending on who you use as a registered agent this is likely handled entirely by them. Renewal of their service simply involves paying their bill, which even if they are expensive is probably only $500, and will include that annual report filing.

Forms 5472 and 1120 will require some input from you, but it will probably amount to 30 minutes the first time you do it with the help of your agent if you have kept accounting records during the year.

Taxes

If you live in a country with low income tax like many internet entrepreneurs, registering a US LLC may be advantageous. When run as a “disregarded entity” without any “Effectively Connected Income“, there’s essentially no tax at the company level. Instead, it must be paid at the personal level.

More legally allowable deductions may also be a benefit. Many people will run their company with limited profits, but their company gives them a lot of benefits, lowering their tax burden.

Tax is complex, but many people choose to do business via a US LLC for these reasons.

Remember: there’s no one size fits all rule when it comes to tax, so if you’re planning to use a US LLC and do not fully understand the tax implications, I can’t stress enough just how important it is to get professional advice.

Corporation vs LLC: Which is Best for a Foreigner?

Like other countries, there are a number of different ways that you can trade as a business in USA.

For example:

Generally, foreign citizens and companies incorporate their US business as an LLC or C-Corp. This is because neither of these types of entities has restrictions on the number of foreign owners.

Partnerships and Sole Proprietorships are not popular as they do not limit the owners from liability in the same way that a C-Corp or an LLC does.

If you are a solopreneur or a small business owner, an LLC is probably the best fit. They are by far the most common choice among foreign small business owners wanting to establish their business in the USA.

The exception to this rule is if you are planning to seek investment capital. C-Corporations formed in Delaware are a particularly popular choice among startups seeking venture capital.

Since I mostly write about lifestyle businesses that online business models can offer, from here on out I’m making the assumption that you want to set up a US LLC.

Which State Is Best to Register an LLC for an Online Business?

I won’t get into the nitty gritty of this, as opinions and biases come into play here. Generally however, you’ll find 2 states to be the most common when it comes to registering online businesses:

- Delaware

- Wyoming

I’m going to massively oversimplify this for the sake of brevity, but they both:

- are cheap to operate out of,

- have no income tax (if not doing business in the state it is registered in), and

- have no sales tax (if not doing business in the same state).

Delaware: For When Investors Are Involved

If you’re taking investment capital from other parties, chances are that Delaware will be the best place to start. Your investors will probably have experience with this state already, and they will likely guide you to it.

This is essentially due to the legal system in Delaware. Delaware’s laws are very business-friendly, and the court is known to be quick in reaching decisions. Due to the number of cases handled, there exists a large body of precedent, meaning fewer unknowns for LLC members.

Though there is no income tax in Delaware, there is a “franchise tax” of $300 per year (flat fee).

Wyoming: For Small Partnerships and Single Members

If you are doing it alone or with only a few others, Wyoming is likely a better bet. Wyoming comes with most of the benefits of Delaware, but:

- is cheaper to set up,

- is cheaper to renew,

- involves less paperwork and

- provides greater privacy.

Simplified further, Wyoming is cheaper and easier to register and operate. In the process below, I’ll walk you through the steps for setting up a Wyoming LLC.

How to Start a Company in USA as a Foreigner

Dear reader, time is your most precious resource.

Setting up a new company might feel like a major task but it really isn’t.

My goal is for you to get set up and making money ASAP. I don’t want you spendingwasting months and months thinking about getting started.

As a foreigner, the process isn’t lightning fast. The first time you set up a US LLC, the entire process can take around 5 weeks.

As you’ll see though, a lot of this time is spent waiting around for other parties. You shouldn’t need to spend more than a day worth of your time in total on this process.

Step 1: Register Your LLC

To start the process you need to work with what is known as a “Registered Agent”. This is essentially a company who will register your new LLC.

You pay your fee, give your agent 2-3 different company names, provide some personal information (which they keep confidential) and details of your business.

I say 2-3 company names, because a quality registered agent will also do a USPTO trademark search for you to ensure you’re not too similar, or identical to something that may cause trouble for you down the road.

Usually your new LLC will be registered within 72 hours.

Action: begin the registration process with a registered agent. I trust Freedom Surfer.

Cost: $319 (use code “jase” at checkout for a discount)

Step 2: Create an Operating Agreement

While not required in most states, it’s a good idea to have an operating agreement anyway. It’s basically a legal document that states the ownership and operating procedures of an LLC.

Having one ensures all business owners are on the same page, reducing the risk of conflict in future.

Step 3: Get a Physical Business Address

This might seem like putting the cart in front of the horse but I like things to be organised. If you don’t have one already, get yourself a business address in the USA.

You can get away with using your registered agent’s address, but often these get flagged with banks and payment processors and cause trouble down the road. This is because tens of thousands of companies are all registered to the exact same address, and in some cases, PO boxes are used.

For this reason, I recommend using a real, physical street address service. There’s no rule saying that your Wyoming LLC needs to use a Wyoming street address, but if you want to raise the fewest flags with banks, it does make sense to do so.

This street address can be used to collect mail which can be scanned or forwarded to you, which can come in handy later on for any IRS paperwork or credit cards you want sent to you (as they will not be shipped overseas).

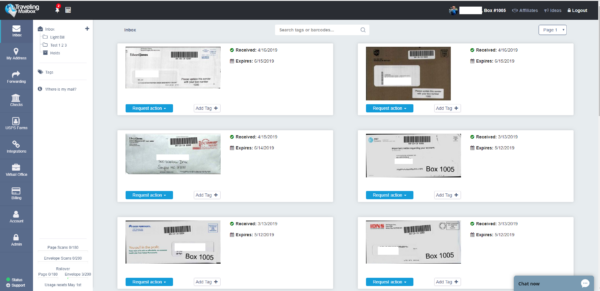

Action: sign up for a physical street address. I like Traveling Mailbox.

Cost: from $150/year

Step 4: Apply for an EIN

In order to set up a bank account, you’ll need an Employer Identification Number from the IRS. An EIN is essentially a social security or tax file number, only for business entities.

If you have an SSN or an ITIN, you can apply for one for free online. If you don’t however, it can be a bit of a hassle to get one. You can do so by:

- Fill in Form SS-4.

- Fax it using a virtual fax service.

- Wait.

If you use a fax service you should receive a return fax within around 4 weeks of applying, otherwise, your virtual address service will open and scan this letter for you.

Many registered agents, like Freedom Surfer, will provide an EIN application as part of their service.

Action: either file Form SS-4 yourself, or consult your registered agent.

Cost: from $0

Step 5: Get a Bank Account

The days of needing to get on a plane to open a bank account are long gone. Traditional banks are becoming increasingly difficult to work with, while newer “digital” banks are quick and easy to set up while having very few fees.

I’m bringing plenty of biases into this discussion, but I feel the 2 best options are:

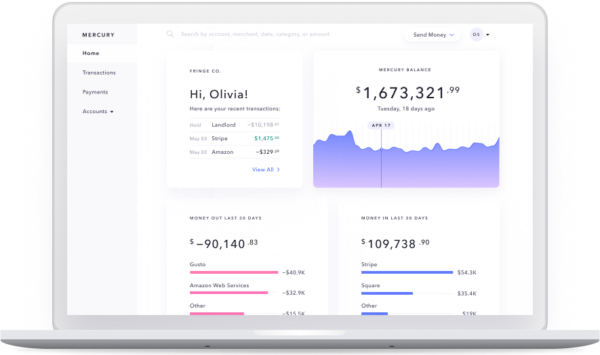

- Mercury: best for ecommerce, SaaS and service businesses, or

- Wise: best for affiliate marketing and content sites that earn ad revenue.

Mercury provides you with many checking and savings accounts in USD, which is great if you’re planning on using something like Profit First for your company. You also get physical and virtual debit cards on demand.

Wise on the other hand, gives you local accounts in Australia, Europe, Singapore, USA, UK and elsewhere. This can be helpful if your business earns income from affiliate marketing and you need local bank accounts for program payouts.

Of course, there’s nothing stopping you from setting up both!

Action: apply for either a Mercury or Wise account.

Cost: free, with a $250 bonus at Mercury

Step 6: Get a Payment Processor

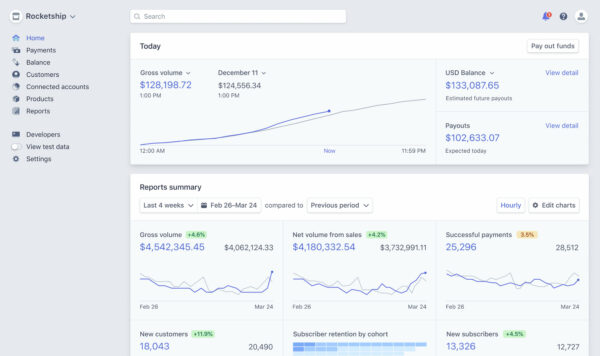

If you plan to process credit card payments, this step is important. In general, your best options are:

Stripe give a better rate, while 2Checkout allow you to process PayPal payments without a PayPal account.

These applications can require you to jump through some hoops. Depending on your level of paranoia and how often you travel, you may want to set up a virtual desktop like Amazon Workspaces to apply and login to these services.

Expect either payment processor to hold your payments for a longer period of time in the beginning. They want to protect themselves in the event of chargebacks, so try to have a few months’ operating expenses in your bank account at the time of opening (and expect them to ask for a screenshot).

Action: apply for either a 2Checkout or Stripe account.

Cost: free

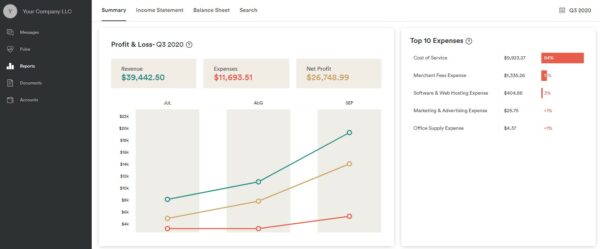

Step 7: Set up a Bookkeeping System

Now that you’re set up you’ll want to make sure you have some sort of accounting system in place, both for record-keeping purposes and to help you run your business well.

If you’re planning on doing the accounting yourself, both Mercury and Wise accounts will auto-import into Xero daily. I do encourage you to not do this yourself though.

A good service can save a lot of time, and it’s work you should really be delegating. You get a company email address for receipts and just forward anything/everything to it, and everything is magically organised.

Action: sign up to a bookkeeping service.

Cost: from $100/month

Time to Trade!

There’s no reason why you can’t be set up and ready to do business with your new US company in around 5 weeks.

Not sure a US LLC is right for you? Take a look at my guide to the best countries to register an online business, or if you’re wanting something more extensive, you might find this free low tax business set up course, run by my friend Kathleen.

As always, don’t hesitate to leave me a comment! If I know the answer I’ll do my best to point you in the right direction.

Please note: I can’t answer any questions relating to visas. I have zero experience in getting a green card or a different visa in the USA.

Good Day, thank you for this information packed write up.

I have two questions, after setting up the account how do I run it? Do I have to be physically present?

The second question is, after incorporating my company in the US, does my company become an American Company?

Thank You

Hi Irving,

You do not need to be physically present to set this up or renew the LLC. Your registered agent can handle this for you.

I’m not sure what you are asking in your second question. To the best of my knowledge there’s no such legal entity as an “American Company”, so this is probably more an an optics/perception thing. If this is the case, I don’t see how anything can be more of an “American Company” than a USA LLC.

After a mess around with US customs when trying to import goods to the US, I am now going through this process of opening a US company now.

Really, really solid advice you’ve listed here.

Something I would certainly add; you can actually call IRS and get a EIN/TIN over the phone in minutes.

I did it for a UK company last week. 30mins on hold, but flew through the application and got an EIN at the end of the call!

Good find/suggestion Tom. Thanks for commenting!

Hey Tom could you elaborate on how you got the EIN/ITIN over the phone?

Did you have an LLC setup ?

Thank you so much for this incredibly helpful article! Covers all the bases and makes everything quite clear. I’m glad you mentioned affiliate marketing and I’ll definitely be looking into Transferwise accounts, however I wanted to ask how traditional banks might treat revenues from affiliate marketing in terms of issuing credit cards and online banking services. I’m quite interested in credit card rewards from major US banks/providers and wanted to know how likely you think they would be to offer these to an LLC (or to the owner) when it’s owned by a non-resident alien, especially given that all or most revenue is from affiliate marketing with partners in several countries.

Hi Asad, thanks for your kind words. In my experience banks don’t really care about affiliate marketing from a expense perspective, they care from a deposit perspective.

Affiliate marketing isn’t hugely new in USA, so you should be able to find a banker who understands what you’re doing. Where I live in Andorra that’s a bit of a different story (and took me a great deal of time to find a banker willing to understand!).

When it comes to rewards cards you’ll probably need to leverage an existing credit record (Nova Credit is a good service for this), otherwise you may need to secure the credit card. The banks basically want to negate their risk, so they may give you a card with $10k limit when you put $10k into a term deposit with that bank. If you don’t repay, they keep your cash.

Do keep in mind that this is with the card in your personal name. To get a card in the business name, you’ll almost certainly need to secure the card.

Hoping this helps!

Hi Jase,

Thanks for the post. Really useful!

I have a question which might be silly. For really early stage product seeking investors, is it essential to register a company first? Can one contact with VCs in advance?

Thanks

Thanks for your kind words Yan.

In my limited experience in raising capital, I think you’ll find the structure of your company will be part of the conversation. Personally I’d pitch the idea/team/etc first, then work out a legal structure that works best for everyone.

Hi,

Thank you for an amazing step by step tutorial regarding setting up a Wyoming LLC. I have a question regarding taxes. If the business address given by the Registered Agent is in Wyoming, will I have to pay state income tax to Wyoming? On the other hand, if I use my own business address in another state say for instance New Jersey, will I have to pay state income tax to both states, i.e., Wyoming and New Jersey.

Thanks,

Matt

Hi Matt, I believe the concept you are wanting to define here is “nexus”. Laws varies from state to state, but I think you will find that a virtual office address in the same state is nowhere near enough to create tax nexus. This article may provide some insight, but as always it’s best to speak with a professional to get specific legal advice.

This is a very helpful article! I have worked with American clients for years and only just realized that setting up a US company makes sense, and am pleased to find out that it is not as difficult as I had assumed. I wonder though, as the foreign director of a US company, do you need to change your visa status? Or does this company/ entity have any implications on the owner/ director’s visa status?

Hey RB! I am not an immigration lawyer so it’s entirely possible I am wrong, but if you are a “non-resident alien” as the Americans like to call us foreigners, there is no visa to change (you don’t have one in the first place). If however, you have a US visa that allows for legal residence in the United States, then there could be both visa and tax implications. Definitely worth speaking with a professional if you’re unsure!

Hi!

Thank you so much for all the information, this is very nice of you to help other people.

I am setting a dropshipping company and I am not sure if I should go for a LLC in Wyoming or LLP in UK. The main doubt of mine is regarding the taxes.

If I don’t sell to the American market, do I pay taxes with the LLC in Wyoming? Also if I sell to Europe, should I pay the VAT by myself or the customer pays it?

Kind regards, and wish you success.

Hi Elton,

Thanks for commenting. Unfortunately it’s very difficult to give a correct, blanket answer to your questions. Tax comes down to a case by case basis, so you’re really best off asking a professional.

If you don’t know someone who can help, I do recommend speaking with Simon from Freedom Surfer as he understands online business inside-out.

Hi Jase,

I am in the process of incorporating my online business and this article has just been amazing to help me with the process and decisions. I am from Australia too, and I wanted to know what the benefits would be to incorporate in the USA instead of Australia? It seems that you have been through this process yourself, and I would be very interested in knowing your thoughts on that.

Hi Yann,

If you haven’t already read it, this article on where to register an online business may be helpful to you. Not because of the list of countries, but because it gives you a thought exercise as to what to consider.

This said, it’s very possible that the best place for you is Australia.

I don’t know if you’ve caught it, but I no longer live in Australia. Andorra is my home now. I’m quite certain if I was an Australian resident, I’d have a company there unless there was a reputation issue (with my clients/customers) or an Aussie Pty Ltd could not access certain marketplaces. The core reason for this is tax. You’ll need to speak with a tax professional to get an accurate answer but my guess is the best structure is to keep your business’ structure in Australia.

All the best in your research!

Hey Jase,

I’m thinking to move to Andorra, and I’m in e-commerce.

What taxes in the US and Andorra I need to expect using foreign-owned US LLC as a resident of Andorra?

Hi Eugene, I’m not a tax lawyer and there are variables here based on your citizenship, corporate structure and amount of income so I can’t give an accurate answer. To keep things simple though, you’re looking at 10%.

Yes, thank you, I thought about 10%.

I just want to thank you mate for your great contribution.

All the best from Spain.

Hi, I have been waiting for EIN as a foreigner for over 50 business days just for them to tell me that I need to re-fax it and probably have to wait another 45 business days. Is this normal to happen? Thank you!

Hi Sorin, I can’t say it’s “normal”, but I’m sure it happens all the time. Faxes are archaic, and it’s crazy that they still need to be used as any time paper is involved it can be lost. But it is what it is. I’d simply fax again and follow up via telephone. Due to COVID-19 there have been lots of delays with the IRS and in my experience and from experiences others have shared with me, their phone support seems helpful (within the bounds of bureaucracy of course!).

I really appreciate the response. Thank you!

Hello Jase,

Great Article.

Had a small question regarding taxes to pay:

Hi Syed,

I’m not a tax lawyer so please do speak with someone professionally, but speaking in generalities if the LLC is set up as a disregarded entity (known to many as a pass-through entity), there’s no tax in the US. It needs to be paid in your home residence. Of course there are variables there — I don’t know where you’re from and what your local laws are…

In regards to a traditional bank, I’d suggest it has more to do with what you require from the bank and possibly credit cards. Chances are these days you will use a payment processor like Stripe who will deposit into essentially any US bank. You might want to choose your bank based on the credit cards they will offer you, and how good their internet banking interface is.

Hoping this helps.

Hello Jase

Thanks for your tips.

Do you happen to know if it is the same process for an art gallery.

Thanks and be well.

Cheers

Lou

Hi Lou, though the process will be similar, I’m guessing your art gallery is a physical business (are online art galleries a thing? I assume so!)… As a result this will radically change the tax implications of the LLC. In addition, there are visa issues to consider as well.

If you do not currently have a visa and need to be physically present to manage the gallery, you will need to find a way to legally be able to do business in the States. I know next to nothing about these two topics I’m sorry! All the best with your research.

Hi Jase, this is very useful.

I’m from Jakarta and I am interested to expand my online business to US.

How does it work if I hire an American cofounder? Do I need an agent? And do you know about permits to follow, or license must have to start online business in US?

Thank you for the article.

Hi Aldrian, glad it’s been of use to you.

Please remember I am not a tax professional and none of this is tax or legal advice.

If you have a US based co-founder, there are more considerations. The two that I am most aware of is that your co-founder may give your company “nexus” in the state where that co-founder lives. This may them mean it’s liable for taxation in that state.

The other thing to be mindful of is, even if it’s considered a disregarded entity and there is zero tax at the “entity level” (your LLC), your co-founder is, by the sounds of it, a US tax resident, and therefore his % of earnings from this entity must be paid on his personal income tax return.

As with anything tax based, a small investment in professional advice is well worth it.

All the best!

Thank you so much for this very useful information and guidance. My question can the new company employ a non-American? if yes could it provide him/ her with a work permit in the US?

Hi Omar, I have zero experience with gaining a visa in the US I’m sorry. I doubt very much that starting your own LLC will help you to work there but I could be wrong.

Hey Jase, I’m from the Bahamas and would like to start a travel agency business. I would like to know what’s your best advice on this. Can I get a business loan for a start up in the US from either Delaware or Wyoming once my company is registered? I would like to place my company in a physical building and actually hire a worker. Next question does the business have to be in either of those states once I do register the company?

Hi Jes, thanks for your comment.

Unfortunately I am going to have ambiguous answers for you at best. In regards to business loans, it’s all going to come down to the lender. A simple example of this is, it’s possible to get an unsecured business credit card for a foreign owned LLC, though many people will be knocked back when they try. Other loans are also possible, it all comes down to how the lender perceives risk. If you have a physical presence and local employee, I’d imagine your chances of getting a loan are much greater than one with absolutely zero presence on US soil.

You do not need to have your business physically located in the same state that it is registered, but I would speak with a tax professional about “Nexus”. If you have Nexus in another state it can mean your DE or WY company needs to pay tax there, so definitely get advice from a professional (not me!).

Hoping this helps to progress your research!

Hi Jase, I am reading that article again as it is really informative. I had some doubt on the pass-through entity US LLC for foreigners. My understanding is that all income tax will be pass through to the individual in their home country. I was wondering how is capital gain treated? Does that get passed through as well to the individual and not taxed in the US?

Hi Yann, if we look specifically at Wyoming, the theory is that 100% of tax liability is passed through to the individual (or entity) that owns the LLC. How this is interpreted then depends on the laws where the individual or entity who owns the LLC is domiciled. As always, this isn’t tax advice, clearly with these topics it’s best to consult someone who knows both US LLCs and your local tax laws inside out!

Thank you, very informative.

Hello, I am from Nepal. I simply want to register my IT company in US. The company is small sized with a monthly income limited to just $2-3 thousand for now. Which state is best and without me presenting in US? Can I open a bank account there? Obviously I need to accept payments so bank account is mandatory.

If I choose any registered agent, will they do everything? If I have a friend in US, can he follow up?

Hi Samir,

With the information you have shared, the simplest solution for registering is a Wyoming LLC, using Mercury Bank. If you use a Registered Agent (such as Freedom Surfer, who offers my readers discounts), they can handle all renewals/filing for you. While you could use a friend in the US to do some filing (not all, as you need a Registered Agent), if they are inexperienced I would err on the side of caution. Costs are incredibly low in USA, so from my perspective there are better ways to cut costs in your business.

Hoping this helps!

Thanks for the information in the article.

In our startup (based in Tunisia) we have a problem with ‘international payment’.

We can’t withdraw money fluently outside the country.

My startup is an online based platform where content creators can sell their works.

Do you recommend starting an LLC company in USA in our case?

Are there any restricted countries?

Thanks in advance

Hi Houssem,

I don’t make any recommendations but something like a US LLC could work for you. The only restrictions I am aware of will be down to banking, and that all comes down to satisfying the compliance/risk departments of the banks. If they understand your business model and ownership structure, and feel it’s all above board it is generally not an issue.

First of all thank you for writing this article and for taking the time to respond to all the comments!

I see most of the article covers online businesses but what if I want to start a consulting company, and invoice US companies for my service, would an LLC work for me?

I don’t know the exact number but I’d bet that there are hundreds of thousands of LLCs doing this every week.

If your question relates to the tax side, you will want to speak with a lawyer to confirm the exact impact on your exact scenario. Things that can affect whether or not it will be favorable include your personal residency, if you have any US based staff members, where your LLC is registered, where your clients are located and if you are serving many of them vs just a few, if you are serving the same clients over and over again or it’s all one-time engagements, and probably some other things that aren’t coming to mind right now.

An alternative for a simple consulting company is a British Columbia (Canada) LLP. Hoping this is helpful to you!

Hi Jase,

Great Article! A couple of questions;

I want to buy a shelf company already set up to compilise on a sales opportunity. Have you got any direction on this?

Also do i need to wait for the LLC to be set up before I get and EIN? Does the EIN have to be in the LLC name?

Cheers

Will

Hi Will,

I don’t have any experience with shelf companies I’m sorry. From what I know of them they’re mostly used in jurisdictions where it’s slow to open companies and bank opening is difficult. USA is neither of these, so I’m not sure it makes sense.

In theory you can register a company and get an EIN (from an agent in USA) within ~72 hours. Maybe that is an option for you.

The EIN is linked to the LLC, so yes it has to be in the LLC name.

Hi,

Ok great if it is that quick I will go ahead and register a company and get the EIN.

Thanks!!

Will

Thank you so much for sharing all this information. Lots to digest and your time in doing so is greatly appreciated. I’m trying to understand if you have a UK based and registered tech platform/app and wish to open up to the US market do you actually have to register in the US or can you just have everything going through the already UK based company and just start? Might be a stupid question, sorry! ????) Thank You!

Hi Suzie, it’s difficult to give a 100% correct answer but in most cases you probably don’t need a new company to get started. It’s very normal for a UK company to trade in USA and vice-versa. Your best bet is to speak with the platform and see if they have any restrictions. If they do, I would research the scenario of the UK entity registering a US LLC (child), purely for trading in that market.

The problem with US LLC is that taking money out of it via dividends will get you hit with a damn stiff 30% tax on dividends. That’s why I set up my online business via Singapore.

Hi Hemant, this is not the case. I am not a tax lawyer so everyone should always seek professional advice, but to the best of my knowledge disregarded entity US LLCs in advantageous states (WY, DE, NV, probably others) do not tax dividends as there are no dividends. You may be thinking of a C-corp which is a completely different entity.

Thank you so much for the precious information.

I am an Italian student who is planning to move to the US as soon as I finish my studies, and my question is: can I open an LLC with my student visa? What do I do after it expires?

Thank you for you attention and consideration. We appreciate you!

Hi Marco, thanks for your kind words!

Your visa is independent of your LLC. You don’t need a visa to open the LLC nor do you need to renew your visa to continue operating your LLC.

Besides Mercury what other options do we have for banking since they declined my application.

Thanks for all this info. I run a home-based, online business in visual marketing services & coaching. I am already registered as a business in the Netherlands. I like to have things set up correctly now I am getting more foreign & American clients. Is it necessary to register as an LLC in the US? Or is it just something that maybe would have tax- and other benefits? What do I need to pay attention to when doing business with the US while being incorporated in the Netherlands. vs. in a state like Wyoming. Hope you can give me some clarity 🙂

Hi Patricia, I encourage you to read this post. As long as you make things easier for your foreign or US clients (pay via credit card for example), there’s probably no need to form a company elsewhere. As to tax or other benefits, this is something you’ll really need to research for your personal situation, or hire a tax lawyer to advise on as I have no experience with your tax system.

Hi Jase,

Thanks for a very helpful article!

After you open a US company, what is the ongoing maintenance effort? Is dealing with US taxes complex and expensive? Do you have to travel to the US at all for any filing, or for example to get a loan?

I’m just wondering how much extra effort and/or money a US company is compared to a country where I actually live, as I want to minimize friction around legal and admin. Could you shed some light on this?

Hi Kacper, I’ve just updated the section of the article titled “Ease of Operating” with some more information for you. If you’re operating a basic business this can be done 100% remotely, very cheap, in very little time. Of course, regulations can change this at any time, but given it’s a core business model for states like Wyoming and Delaware, I doubt it will increase substantially any time soon.

In my experience doing business there is about as easy as it gets. I don’t need debt for my businesses though, so if this is a requirement for you, it will probably be difficult until you build a credit record. I imagine in the debt scenario, wherever you are resident will be the easiest place to find capital.

Hi this is a great article. I’m wondering if you have any information whether this all applies to an existing business in the USA. We live in the UK and are wanting to buy an online business already set up and running in the USA – we don’t want to move we could do it all from the uk.

Hi Paige, this article is about opening a company in USA so it’s likely that most of this information is irrelevant. You’ll want to speak with a tax lawyer to decide what sort of entity is right for you as a UK resident.

Hi Jase, this is perhaps the most useful article I’ve ever read. I truly appreciate what you put together here.

Hello, thanks for the detailed information. However, I have tried reaching Freedomsurfer from their website but haven’t gotten any response to date. Is there any way I can reach them aside from their website? I will be looking forward to your feedback.

Hi Kingsley, my experience with most service providers is that they aren’t extremely responsive. I’m confident you’ll hear from them in the next few days.

Hi, I am recently wanting to set up a business in the US regarding a corp or llc. I’m from Canada and I’m finding out that I could be double taxed with an llc but not a corp. Is there away around this to set up an llc. The business I want to set up is an online ecommerce business. Thanks.

I am not a tax expert but my assumption is you are less likely to be taxed twice when the LLC is a disregarded entity formed in one of the ‘desirable’ states (DE, NV, WY, maybe others). I have to assume that many Canadians have companies in the USA, so the good news is that finding a lawyer to give accurate guidance shouldn’t be too difficult.

Great write up! After struggling with trying to get ecommerce payment processors, I ended up with this as a solution. I’m working to getting setup now.

How do you resolve the issue of having your US LLC phone-verified by Google and a growing number of companies you sign up with, if you’re a foreigner and don’t live in the US and have no mobile US phone number? Any suggestion for a work around?

I’m not clear on what you’re trying to achieve with Google; this article is certainly focused on getting set up and not much more. However I personally use Twilio a lot, not necessarily for pretending to be somewhere, it’s just a very simple/affordable way to get a different phone number for each business, or country that you operate in. There’s a bit of a learning curve to it, but it’s been worth learning from my perspective.