For many of us, Europe is a strategic place to live. You’re a short flight to the numerous markets that make up Europe itself, as well as the UK and the rest of the Eastern Bloc.

Timezone wise, you’re able to take a call with Asia in the morning, take your midday break, and then be ready to speak with the Americas in the afternoon and evening.

The heavy demand for tourism here shows that there’s something for everyone. Whether you’re an art history buff, foodie, culture addict or outdoor adventurer, the continent has it all. If you’ve ever visited, there’s a good chance you’ve also dreamt of living here as well.

Unfortunately, the other thing Europe is known for is its high tax rates. While the cost of living can be agreeable in some parts of the continent, if you’re earning a reasonable income, the value proposition often doesn’t add up.

Here’s the thing, though—there are in fact several countries that fall below this norm.

Of course, that alone is not a good unit of measure, since low income tax rates don’t automatically make a country worth living in. There are plenty of other factors to consider as well, such as safety, access to the things you enjoy, cost of living and so on.

In this post, I’ll walk you through some countries in Europe with the lowest income tax, and give you some personal perspectives on each.

Low Income Tax ≠ Liveable

If you haven’t read it yet, check out my article covering the best places for entrepreneurs to live. Even if you’re not a business owner and you’re simply looking for somewhere in Europe to retire or work from remotely, many of the same considerations apply.

By default, much of Europe ticks most people’s boxes, but even still there’s some nuance both between countries, and the cities and regions within each country.

Everyone’s list of criteria differs, but some examples include:

- Is personal safety a concern? Do I have to be thinking about my wallet at all times?

- Is public transport reliable or do I need to buy and drive a car instead?

- Are properties well built and comfortable to live in?

- Do people speak my language in this location? If not, am I willing to learn their language, or am I happy feeling isolated at times?

- Can I get the sort of food I like?

- Is the internet reliable?

- What are the airport connections like?

- Am I able to enjoy my hobbies in this country?

- Is it easy or difficult to make new friends there?

It takes time to work out what is important to you. Perfect doesn’t exist, so instead you need to be able to let go of the unnecessary and focus on the key things that matter the most.

Using myself as an example, I wanted to live in a place where I’d gain access to:

- a safe, clean environment to raise a child,

- a great schooling system,

- reliable internet,

- easy access to the sports and hobbies that my wife and I value the most,

- interesting people, both locally born and location independent entrepreneurs who have chosen to relocate.

Europe’s Lowest Income Taxes

It can take some digging, but there is a sweet spot to be found where liveability and low income tax converge to form the ultimate overlap in your venn diagram.

These European countries are the ones worth seriously considering if you’re planning to put down roots.

Before we dive in, it’s worth noting that the list is in alphabetical order. That doesn’t mean that any are the ‘best’ option. Choosing a place to live is so subjective—my top choice might not be yours. In fact, it very probably won’t be.

Andorra

- Income Tax: 0-10%

- Tax System: Residential

- Cost of Living Score: 4

- Residency Requirement Score: 4

- Pros: Safe, great for building a family

- Cons: Language barrier, small country

Andorra’s tax system is simple. Levied at a maximum rate of 10% for both individuals and corporate entities, it’s little wonder more and more expats are looking to hang their hat here.

After living in Andorra for what is fast approaching a decade, my wife and I are still exceptionally happy here.

So much so, that we chose to start a family in the country, and though parenting without family support can be challenging at times, we’re both on the same page in thinking that we chose the right place (for us) to do so.

Andorra’s healthcare system has supported us every step of the way, from simple health checkups and dental visits, to a place we could trust for the birth of our child.

The Andorran school system is excellent as well, giving students a quadrilingual education by the time they are finished. The country just so happens to be ranked as one of the safest countries in Europe as well.

While obtaining residency in Andorra is out of reach for many workers, if you’re self-employed or have made your money in a past career, it’s probably still doable.

How long that remains the case, I don’t know. The country seems to be looking to a Monaco model of development, bringing in more high net worth individuals, with what seems to be increasingly strict residency requirements.

But as you’ll see, many other countries in this list are raising the bar as well, due to unprecedented demand.

While residency is straightforward, naturalization is a bit more of a task. Citizenship in Andorra can’t be fast tracked by investment. Unless you marry a local, you’ll need to maintain residency for 20 years before you’re eligible for a passport.

Bulgaria

- Income Tax: 10%

- Tax System: Residential

- Cost of Living Score: 3

- Residency Requirement Score: 5

- Pros: Low and simple tax system, friendly people

- Cons: Underfunded public education, language barrier

Bulgaria is the only country in Europe that hasn’t changed its name since it was first established in 681 AD. What has changed is that Bulgaria offers the lowest EU income tax rate of 10%.

The country has a simple and straightforward tax system with few deductions and exemptions. You can also benefit from the double taxation treaties that Bulgaria has signed with more than 70 countries.

While public healthcare and education are not great, there are several public and private hospitals and schools available. The country also provides easy access for foreigners to open bank accounts and general financial services.

If you want to become a resident of Bulgaria, you have several options depending on your situation. One of the easiest ways is to obtain a long-term stay visa and then apply for a residence permit.

Another option is to apply for the Bulgarian Investment Immigration Program, which grants permanent residency and citizenship to investors who meet certain criteria.

For example, you can invest €512,000 in Bulgarian government bonds for five years and get permanent residency in six months. After five years, you can apply for citizenship if you double your investment or maintain it for another two years.

Bosnia and Herzegovina

- Income Tax: 10%

- Tax System: Residential

- Cost of Living Score: 3

- Residency Requirement Score: 5

- Pros: Low cost of living, beautiful scenery

- Cons: Political instability, poor public infrastructure

Bosnia and Herzegovina (BiH) has the last remaining jungle in Europe, called Perućica. Luckily their tax system isn’t a jungle, as BiH has a flat personal income tax rate of 10%.

BiH consists of the Federation of Bosnia and Herzegovina (FBiH) and the Republika Srpska (RS), with a third region. Each entity has its own tax system and legislation, but they share some common features.

BiH offers some attractive incentives for expatriates who work or invest in the country:

- Foreign nationals who perform independent business activities through a permanent place of business in FBiH are exempt from income tax on their income generated from such activities for the first five years, and

- foreign nationals who invest at least €2,000,000 in FBiH or €1,000,000 in RS are entitled to a 50% reduction of their personal income tax liability for the first five years.

Living in BiH you will find a high quality of life in terms of living costs and the country’s natural beauty. But expect lower quality and availability of healthcare and educational systems. In recent years the country has also been plagued by political instability.

For residency, you have two options:

- Apply for a temporary residence permit based on employment which is valid for up to one year and can be renewed annually.

- Apply for a permanent residence permit based on having invested at least €500,000 in BiH economy or real estate property worth at least €250,000.

The Czech Republic

- Income Tax: 15-23%

- Tax System: Territorial

- Cost of Living Score: 3

- Residency Requirement Score: 6

- Pros: Good infrastructure, low cost living

- Cons: Bureaucratic and complex tax system, cold winters

The Czech Republic is well known for its beer, which is cheaper than water in some places. It is a good benchmark for a country that can provide you with a great quality of life, as well as well-developed healthcare and education systems.

The country has a progressive income tax system that is relatively complex and requires a lot of paperwork. Tax authorities are strict and may impose penalties for late filing, incorrect filing or underpayment of taxes.

In general, there are two tax rates for individuals:

- The 15% uniform tax rate applies to gross income up to the social security payment cap of $79,000, and

- the 23% rate applies to gross income exceeding this threshold.

However, European self-employed individuals have the option to utilise a lump sum tax deduction and decrease the standard tax rate by 40% or 60%. This results in a practical tax rate ranging between 6% and 9% for self-employed entrepreneurs.

As for residence, the requirements in the Czech Republic depend on the nationality and purpose of your stay. There are no residency investment programs, so if you want to be a temporary resident, you will need to apply for a long-term visa.

Estonia

- Income Tax: 20%

- Tax System: Residential

- Cost of Living Score: 3

- Residency Requirement Score: 5

- Pros: Good public infrastructure, digital society

- Cons: Reserved locals, cold and dark winters

Estonia is a small Baltic nation with one of the lowest income tax rates in Europe at 20% for individuals and corporations, regardless of their income level or source.

This means that you can enjoy a simple and transparent tax system that does not penalise you for earning more.

It is also one of the most digitally advanced countries in the world, with 99% of public services available online.

The healthcare system is universal and accessible, with a high level of satisfaction among patients. The education system is also well-developed and ranked among the top performers in the world, especially in science and mathematics.

Getting residency in Estonia is not very difficult, as there are several options available for different types of applicants. One way is to apply for an e-residency, which is a digital identity that allows you to access Estonian online services and run a business from anywhere in the world.

You can also apply for their Major Investment Program, which provides residency through investing €1,000,000 into Estonia’s economy.

Georgia

- Income Tax: 1-5.75%

- Tax System: Territorial

- Cost of Living Score: 3

- Residency Requirement Score: 5

- Pros: Simple tax system, low crime rate

- Cons: Poor infrastructure, political instability

Georgia is a small nation in the Caucasus region, bordering Turkey, Armenia, Azerbaijan and Russia. It’s also one of the most diverse countries in terms of languages, with 14 different language families spoken by its people.

The income tax system is relatively simple and flat. The country’s income tax rates range from 1% to 5.75%, depending on your taxable income and filing status.

Georgia does not tax certain types of income, such as dividends, interest, capital gains, royalties and rental income from foreign sources. However, in some cases, you can be subject to federal capital gains tax of up to 20%.

Georgia also offers some incentives if you want to relocate to the country. One of them is the High Net Worth Individual program, which allows you to pay a flat annual fee of about $7,800 instead of regular income tax.

The quality of life in Georgia is high, but don’t expect great public infrastructure. Still, you can find several private healthcare and schooling opportunities, especially in Tbilisi.

While there is no formal residency by investment program, you can obtain temporary or permanent residence permits by investing $100,000-$300,000 into real estate or commercial enterprise.

Gibraltar

- Income Tax: 10-29%

- Tax System: Territorial

- Cost of Living Score: 7

- Residency Requirement Score: 4

- Pros: English speaking, Mediterranean lifestyle

- Cons: High cost of living, small country and not many real estate options

Situated at the southernmost point of the Iberian Peninsula, adjacent to Spain, Gibraltar stands as a British Overseas Territory. This unique status ensures its autonomy in crafting its tax laws, even though it remains a sovereign entity under the British domain.

In the past, Gibraltar was infamously known as a tax haven for “monkey business”. Ironically the country is also home to the only wild monkey in Europe, the Barbary macaque.

Today the country is a legitimate place to conduct business and has a somewhat complicated but favourable progressive income tax system ranging from 10% to 29% on its residents.

There are two ways of getting residence in the country:

- establish a business, or

- showcase significant wealth.

Typically, entrepreneurs find the business route more accessible, but validating wealth can be less complicated, and the High Executive Possessing Specialist Skills (HEPSS) is one way of doing so. HEPSS caps the tax you need to pay on your salary.

You must earn more than £120,000 annually, but the tax is only applicable to the initial £120,000, essentially levying a fixed tax of £29,940. To qualify, you also need own real estate or have a long-term rental in Gibraltar.

Besides the low-tax environment, Gibraltar also offers its residents a high quality of life. It has a vibrant and cosmopolitan community, with English as the official language and Spanish widely spoken. However, life comes at a higher cost of living.

Hungary

- Income Tax: 15%

- Tax System: Residential

- Cost of Living Score: 3

- Residency Requirement Score: 6

- Pros: Good public infrastructure, diverse culture

- Cons: Language barrier, cold winters

Hungary is a Central European nation with a rich history, low-cost living and the world’s largest thermal water cave system, with over 1,200 hot springs and spas. A big plus in my book when it comes to your overall wellbeing.

The country has a flat personal income tax rate of 15%. Dividends, capital gains, and interest are also taxed at 15%, and there is a maximum annual social contribution of €2,000.

Healthcare is affordable, the country has a high medical education and research standard, and many doctors and dentists speak English. The biggest downside is that Hungarian winters are historically known to be merciless, dropping as low as -20 Celsius.

To become a tax resident in Hungary, you must either reside there for 183 days or more within a year or maintain a permanent residence there. If you have homes in several nations, including Hungary, your primary centre of interest should be within Hungarian borders.

Malta

- Income Tax: 15-35%

- Tax System: Territorial

- Cost of Living Score: 4

- Residency Requirement Score: 5

- Pros: Sunny weather, EU membership

- Cons: Overcrowded, water scarcity

Malta is a small EU nation island in the Mediterranean Sea and one of the most densely populated countries in the world, with over 1,300 people per/km2.

Malta is one of the lowest income tax countries in Europe, with income tax rates between 15-35% and corporate tax rates dipping to as low as 5% for companies based outside its borders.

Residents are subjected to a set €15,000 “minimum tax” annually, which, with careful planning, can also be the upper limit. Furthermore, foreign capital gains remain untaxed even if transferred to a Maltese bank.

For some time, Malta has maintained a flat-fee residency program. However, the newer Global Residence Program is now becoming a preferred option for permanent residency.

Distinct from places like Andorra and Monaco, Malta doesn’t mandate a physical presence on its twin Mediterranean islands. Essentially, you can secure residency without residing there.

Moldova

- Income Tax: 12-18%

- Tax System: Residential

- Cost of Living Score: 3

- Residency Requirement Score: 5

- Pros: Low cost of living, rich cultural heritage

- Cons: Poor public infrastructure, high corruption

Moldova is a small and densely populated landlocked country in Eastern Europe, located between Romania and Ukraine. It has a democratic republic system and an association agreement with the EU since 2014.

Moldova offers a flat income tax rate of 12% for residents on most types of income, such as employment, professional, entrepreneurial, capital gains, and other taxable income.

The country offers some incentives for expatriates who work or invest in the country. For example, foreign citizens who invest at least €100,000 in Moldovan companies or real estate can obtain a residence permit for up to five years.

Expect a low cost of living, as the average monthly salary is €400 and expect to get high value for your money on goods and services.

However, note that the public healthcare and financial system is rather poor, and the country is experiencing higher corruption levels.

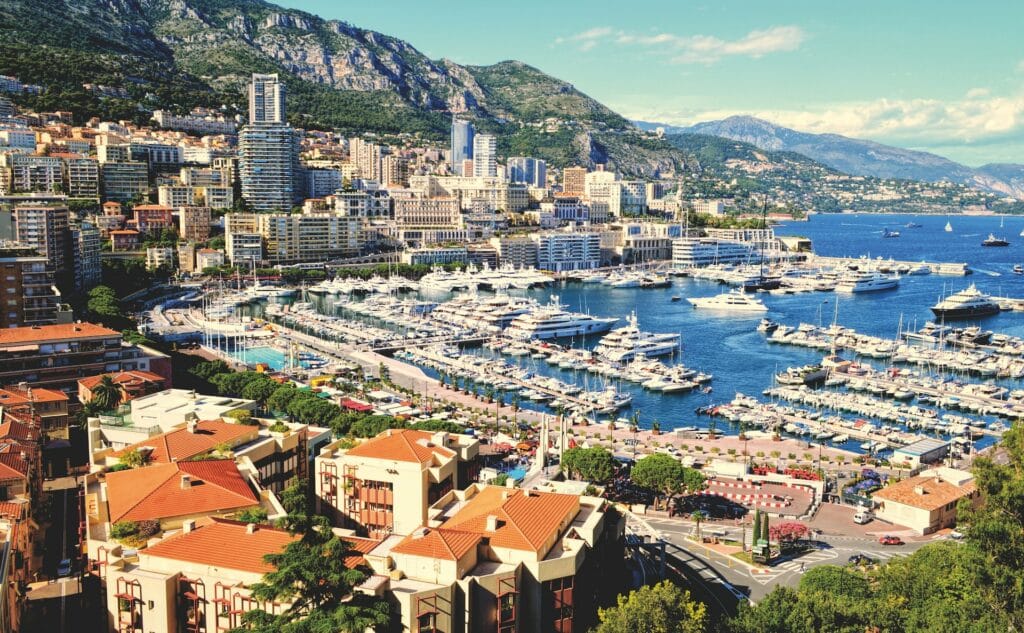

Monaco

- Income Tax: 0%

- Tax System: Territorial

- Cost of Living Score: 9

- Residency Requirement Score: 4

- Pros: High standard of living, no taxes

- Cons: High cost of living, limited housing opportunities

This tiny principality is the second smallest country in the world, but it has the highest GDP per capita and the lowest poverty rate. The cause is simple; you need to be rich to live in Monaco.

Monaco’s personal income tax remains at a 0% rate unless you are a French national, at which you will be subject to French income tax.

If you want to acquire residency in Monaco, the path is relatively straightforward:

- You need to make a bank deposit of €500,000, and

- purchase (or rent) property in Monaco.

Still, keep in mind that parking spaces often sell for up to €1,000,000, so residence in Monaco is reserved for the wealthiest entrepreneurs and investors.

Also, you must spend three months per year for the first nine years, after which you can obtain what is effectively permanent residence.

Montenegro

- Income Tax: 9-15%

- Tax System: Residential

- Cost of Living Score: 3

- Residency Requirement Score: 5

- Pros: Beautiful natural scenery, great real estate options

- Cons: Political instability and corruption, language barrier

Montenegro has one of Europe’s most competitive personal income tax rates at 9-15%.

Although the broader Eastern Europe region offers commendable tax rates in the teens, Montenegro stands out and is nicknamed “the pearl of the Mediterranean” for its natural beauty.

The country prides itself on good healthcare, education and stunning beauty, especially during the summer. There are plenty of real estate opportunities available at a reasonable price.

This said, many residents will choose to go to Croatia for healthcare, as well as opt for private schooling. If you choose to live near the coast, the heavy tourism can be unbearable during summers, so many will take the chance to travel abroad, or locally to cooler, less touristed inland towns like Kolašin.

Montenegro allows property owners to secure a temporary residence card, renewable annually. Alternatively, you can open a company in Montenegro which will provide you and your dependents visas and permission to reside and work.

Portugal

- Income Tax: 14.5-48%

- Tax System: Residential

- Cost of Living Score: 4

- Residency Requirement Score: 5

- Pros: Low crime rate, family-oriented spaces

- Cons: Bureaucracy and red tape, language barrier

Portugal is a good place to live and one of the most peaceful, ranking third in the Global Peace Index. Still, the country isn’t typically the first name that comes to mind when considering low-tax nations with income tax rates from 14.5-48%.

However, if you are not Portuguese, you can opt into the ten-year Non-Habitual Resident Tax scheme, which could potentially exempt your foreign-sourced income from any Portuguese tax up to 100%.

But there’s a twist. Not every tax-efficient structure is compatible with Portugal’s tax exemptions. Earnings originating from countries on Portugal’s tax blacklist don’t qualify for the exemption.

For example, If your income comes from offshore entities in places like the BVI or Hong Kong, you cannot qualify for tax exemptions.

All things equal, Portugal offers great opportunities to build life and wealth in parallel in a beautiful, developed, affordable part of Europe.

Romania

- Income Tax: 10%

- Tax System: Residential

- Cost of Living Score: 3

- Residency Requirement Score: 5

- Pros: Low and straightforward tax system, friendly people

- Cons: Poor infrastructure, high level of corruption

There is a risk when walking in Romanian forests, as the country is home to the largest population of brown bears in Europe. Luckily there is little threat to your livelihood on the tax front.

Romania has a simple tax system with a flat personal income tax rate of 10% for most types of income, including salaries, pensions, dividends, royalties, and interest.

Moreover, if you receive salary income from abroad for work performed abroad, you are exempt from Romanian income tax unless you prove that you are a tax resident of another state with which Romania has a double tax treaty.

Another benefit of living in Romania is that you can deduct certain expenses from your taxable income, such as social security contributions, health insurance premiums, and personal deductions for yourself and your dependents.

While Romanians are known as hospitable and friendly, their government has been subject to higher corruption resulting in less funded public infrastructure. Things are getting better, but rely on private healthcare and education for your livelihood.

You need to spend at least 183 days in Romania to obtain a registration certificate for residency. If you are a non-EU citizen, you can obtain a temporary residency permit by registering a company and appointing yourself as the director.

Serbia

- Income Tax: 10-20%

- Tax System: Residential

- Cost of Living Score: 3

- Residency Requirement Score: 6

- Pros: Low cost of living, rich culture and history

- Cons: Poor financial systems, limited international schooling

Serbia has a competitive tax system with a flat tax rate of 15% for individuals, much lower than many Western countries.

Serbia also has a bid for EU membership, so if you are looking to become an EU resident in the future, this could be a way. The country’s growing economy, combined with its low cost of living, positions it as an ideal destination if you earn your income abroad.

Financial services are available for expatriates, but Serbia has not signed the CRS (Common Reporting Standard), which could prove a compliance issue for some businesses.

There two most common paths acquiring residency are via:

- the purchasing of real estate, or

- registering a company.

Required application documents are similar to that of other Balkan countries and include proof of health insurance, proof of income or real estate ownership, among others. The application process is transparent is generally smooth.

Switzerland

- Income Tax: 0-11.5%

- Tax System: Residential

- Cost of Living Score: 8

- Residency Requirement Score: 4

- Pros: High quality of life, low taxes and easy immigration

- Cons: High cost of living, conservative culture

If Switzerland is a place you want to call home, you’ll also get a stamp of credibility that few low-tax countries can boast.

While living in Switzerland isn’t light on the wallet, what you get in return is an unparalleled quality of life and peace of mind knowing the maximum tax you would face is 11.5%.

If you plan it right, you could enjoy a tax rate dropping below 10% if you’re in the high-million income bracket.

One route to becoming a Swiss resident is by setting up a business in Switzerland and hiring local employees.

For those seeking a straightforward approach, Switzerland offers lump-sum taxation. Instead of taxing your income, your tax is calculated on the basis of your total annual cost of living in Switzerland and abroad for yourself and your dependents.

However, based on your chosen canton, the tax rate can run you anywhere from $150,000 to $1,000,000 annually. Keep in mind Zurich will not be an option for this arrangement.

Final Thoughts on Europe’s Lowest Income Tax Destinations

Living in Europe does not need to mean you’ll pay insanely high tax on your income.

Several countries offer much fairer rates, large tax exemptions, low property taxes and other benefits, in an effort to attract high value individuals to their nation.

However the lifestyle these countries offer vary wildly, from local culture (both good and bad), to safety, climate, education for your kids, or practical things like reliable internet.

The lowest income tax in Europe does not equal the highest quality of life for everyone. Which country you are considering? Leave me a comment below!

Leave a Reply