The large majority of the world’s countries make their money by taxing local residents and businesses. While most people bemoan the policy, the money derived from income and corporate tax is (typically) used for funding everything from roads and infrastructure to healthcare, education and more.

There are however a small handful of countries that charge zero income tax. It might seem attractive to live somewhere that you get to take home your whole pay cheque, but it does make you wonder. How do tax-free countries work? Where do they earn their revenue if not from the hardworking masses?

Tax may be the most obvious solution to keeping a country afloat, but it’s by no means the only one. There are in fact numerous other revenue sources that governments can tap into should they choose not to impose tax on their residents.

My goal is to show you some of the lesser known (and often lucrative) ways that governments are able to make money without directly taxing it’s residents.

But First, What Are Tax Havens?

Most countries rely on taxes derived from individuals and businesses to run the show.

Countries that don’t do this are typically branded with the term “tax havens”. Not all tax havens are the same, however, and really, the term itself is very subjective.

In the way that most people use the term, a tax haven is a country or independent area that imposes little or no income tax.

They’re typically stable from a political and economic standpoint and generally offer favourable residency or citizenship by investment programs, which are advantageous both to the individual taking part, and to the country itself.

That being said, some tax havens are also secrecy jurisdictions. Rather than prescribe to the (increasingly) internationally accepted practice of information sharing, they’ve taken a non-disclosure approach when it comes to financial matters that take place within their borders.

Put another way, they provide privacy, or secrecy to those who want it.

Often these countries also have favourable company tax law, allowing non-resident owners to appoint “resident directors”, and circumvent the CFC rules of many countries.

What I find fascinating about this is, these countries know what they’re doing. They play the game of avoiding blacklists by being competitive enough for those seeking lower taxes while satisfying enough criteria to avoid being listed.

But as you’ll see below, whether transparent or not, tax havens are anything but tax-free. These countries have numerous other income sources to tap into that more than make up for the income and corporate tax they’re choosing not to levy.

Customs and Import Duties

One way tax-free countries can make money is with customs and import duties. By imposing tariffs (which are often very hefty) on imported goods, they’re able to supplement the income they would otherwise have gotten from taxing their citizens and the companies that do business within their borders.

In many cases these are commonly purchased goods and services like alcohol, tobacco, electricity and fuels, all of which typically sell in high volumes both to residents and tourists.

The downside to these import duties is that they’re passed onto the consumer as indirect taxes. In countries where income taxes are levied this isn’t as much of an issue, since the tariffs imposed on imported goods are usually not that high.

However, in tax-free countries the tariffs are hiked to make up for the lack of income tax revenue. This pushes up the cost of living for residents. When you look at it from this perspective, people in these countries aren’t exactly living tax-free.

Corporate Registration, Renewal & Maintenance Fees

The lack of corporate tax in most offshore financial centres makes them especially appealing to entrepreneurs seeking the best place to register their business and lawyers seeking jurisdictions for complex corporate structures.

But make no mistake, governments still benefit from having them do business in their country.

They do this by charging newly incorporated business entities a registration fee. Not only that, they also require these companies to pay an annual renewal fee in order to maintain their status as an operating company.

These fees are nowhere near what a government might get if they imposed corporate tax on a company. But, if you take into account the sheer volume of businesses setting up shop, there’s no doubting these governments are coining it.

The British Virgin Islands reportedly collects more than $200 million in corporate fees each year from an estimated 950,000 companies.

Not only do these fees directly provide revenue to the government, but the many service providers who support this market also benefit. Oftentimes they charge sales tax, pay company maintenance fees themselves, and so on, all of which further supports the government.

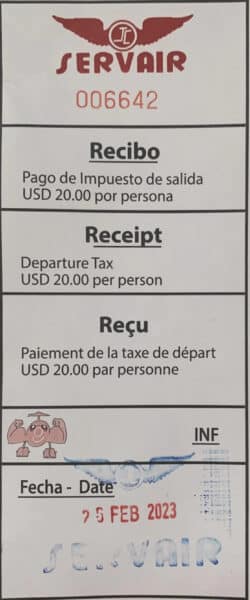

Departure Taxes

For tax haven countries with a booming travel and tourism trade, there’s plenty of money to be made from departure taxes. A departure tax is exactly what it implies.

Whenever a person leaves a country a fee is levied. Also known as airport tax, anyone passing through an airport must essentially pay for the privilege. (Think of it as the opposite of what happens when you pass GO on a Monopoly board.)

If you haven’t knowing paid this, you’re not alone. In many countries, it’s baked into the price of your airline ticket and is claimed to be used for things like maintenance, administration and airport improvements.

For this reason, these taxes all have different names. Dubai has it’s departure fee, Qatar has it’s passenger facilities charge, and Singapore has an airport development levy.

Most of the time the revenue goes through the airport facility first before a portion is funnelled back to the government. But at scale, you can see how it’s a decent money printer.

Tourism

Tourism can be a huge source of revenue for a country, provided of course that it’s safe and appealing to visit. The industry is a dominant player in the global economy.

Valued at $4.06 billion in 2021, it’s predicted that the global travel and tourism industry will reach a massive $16.20 billion by the end of 2031. For governments on the receiving end, it’s a pretty sweet deal.

Not only is the influx of visitors spending their money on local goods and services, they’re also paying for a visa to gain entry to their holiday destination of choice. And let’s not forget the aforementioned airport tax that’s lumped into the cost of their plane ticket.

Remember, most things being purchased locally bring with it a sales or value-added tax. The companies providing those goods and services often pay registration and license fees as well.

Other Non-tax Revenue Sources

There are many other non-tax revenue sources in addition to the ones mentioned above. These include work permit fees, interest from debts and loans as well as public service fees for things like transportation, local services, infrastructure supplies and so on.

Even foreign investment can serve as a form of revenue for tax-free governments. Because while the taxes on foreign investments are minimal, there are other fees that may be levied. As they say, there’s no such thing as a free lunch.

Final Thoughts

How does a government make money besides taxes?

As you can see, countries with no income tax can actually generate a lot of revenue from other sources. But, while it may seem appealing to get residency in a tax haven, it’s important to recognise they come at a cost.

Outside of the International Monetary Fund and Oxfam’s concerns of tax havens doing harm to other nations around the world, there’s also the personal cost of living in one of these countries.

Oftentimes true tax havens bring added hassles into the lives of it’s residents, and they are subject to more compliance by banks and similar financial entities, higher costs of living, and so on.

If you’re wanting to reduce your tax burden while also keeping your cost of living affordable and overall administrative hassles to a minimum, a better approach may be to find a low tax country, or one with a high headline tax rate, but many legal paths to reducing the actual amount that you pay.

An example of this is the small country that I have chosen to call home, Andorra. Corporate and individual tax in Andorra is capped at an agreeable 10% and the benefits one receives in return (free public schools and excellent healthcare, to name just two) are first class.

Check out my guide to getting residency in Andorra for insight into what this sort of move takes.

Leave a Reply